When Life Knocks Your Finances Off Track

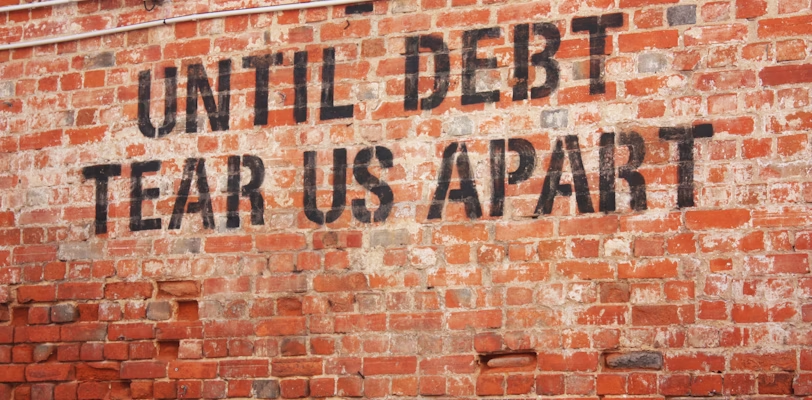

I’ve been there—when life throws an unexpected financial disaster, and suddenly everything feels like it’s falling apart.

It might be:

- A job loss or sudden drop in income

- Medical bills or emergency expenses

- A divorce or major life change

- Natural disasters or events out of your control

When these moments hit, it can feel overwhelming. Your credit cards might spike, bills pile up, and the thought of recovery seems impossible.

But here’s the truth: You can come back from a financial disaster.

It starts with a clear plan and consistent action.

Assess the Damage Honestly

The first step to recovery is facing the full picture of your finances—even if it’s uncomfortable.

- List all debts, balances, and interest rates

- Track current income and any temporary relief (severance, insurance, benefits)

- Take note of essential vs. non-essential expenses

Seeing it all in one place is scary but liberating. Once you know the damage, you can create a recovery plan instead of reacting in panic.

External Resource: Consumer.gov – Getting Out of Debt

Helpful Read: How to Go from Surviving to Thriving Financially

Secure Your Essentials First

Before worrying about long-term goals, protect the basics:

- Food and shelter

- Utilities and transportation

- Minimum payments on essential debts

If necessary, contact creditors and service providers to explain your situation. Many offer:

- Temporary forbearance or deferment

- Reduced payment plans

- Late fee forgiveness

Your priority is survival first—then recovery.

Build a Mini Emergency Fund

Even in disaster mode, having a small emergency fund can break the cycle of relying on credit cards for every surprise.

- Start with a goal of $500–$1,000

- Use side income, selling items, or tax refunds to fund it

- Keep it in a high-yield savings account for easy access

This small cushion provides mental relief and prevents setbacks from turning into more debt.

External Resource: Bankrate – How to Build an Emergency Fund

Helpful Read: $10K Saved on a $40K Salary: My Simple Plan

Create a Realistic Debt Recovery Plan

After stabilizing, the next focus is tackling debt strategically.

- Prioritize high-interest credit cards first (avalanche method)

- Consolidate or transfer balances to lower-interest options if possible

- Avoid taking on new non-essential debt

If the debt feels unmanageable, credit counseling or a debt management plan can provide structured relief without ruining your credit like bankruptcy might.

External Resource: NerdWallet – How to Pay Off Debt

Helpful Read: The 5-Step Blueprint to Eliminate Debt and Build Generational Wealth – A proven system for long-term recovery.

Find New Income Streams to Accelerate Recovery

Cutting expenses only goes so far. To rebuild faster, look for ways to boost income:

- Pick up freelance or side work based on your skills

- Sell unneeded items to generate quick cash

- Explore gig apps or part-time work for immediate income

Even an extra $300–$500/month can significantly speed up debt payoff and rebuilding savings.

Helpful Read: The Ultimate Side Hustle Guide for Extra Income

Rebuild Credit and Confidence

As you recover, focus on repairing your credit profile to open doors for better rates and opportunities:

- Pay all bills on time moving forward

- Keep credit utilization low (under 30%)

- Consider a secured credit card if accounts were closed

Rebuilding confidence is just as important as rebuilding credit. Each small win—paying off a card, hitting a savings goal—proves you’re back in control.

External Resource: Experian – Credit Recovery Tips

The Bottom Line

Recovering from a financial disaster is never instant, but it is absolutely possible.

The formula is simple:

- Face your situation with honesty

- Secure your essentials

- Build a small emergency cushion

- Attack debt strategically

- Boost income and rebuild credit

Every small step moves you closer to stability, confidence, and eventually wealth.

Your Next Steps

If you’re ready to go from crisis to control:

The Psychology of Money: How Your Mindset Shapes Your Wealth

How to Go from Surviving to Thriving Financially

5-Step Blueprint to Eliminate Debt and Build Wealth

Michael J. Carter

Michael J. Carter helps readers master personal finance, practical investing, and long-term wealth building. At The Golden Safe, he turns complex money topics—like debt payoff, dividend ETFs, cash-flow systems, and money management—into clear, step-by-step guides and tools that make financial education actionable today.